A recent study shows the average Canadian household debt remains near record high levels with the average Canadian owing close to $1.78 for every dollar earned, which is why Calgary-based fintech startup Consumer Genius launched Juggling Debt earlier this year.

More recently, the startup expanded on its fintech portfolio with the launch of Canadian Life Rates and Loanz.ca, two new platforms providing specialized online financial services to Canadian consumers.

Life insurance is essential for those who want to prepare for unexpected events, says Consumer Genius. And debt relief can also prove critical. Combined with Juggling Debt, Consumer Genius believes it provides one ecosystem for rapid digital access to financial services.

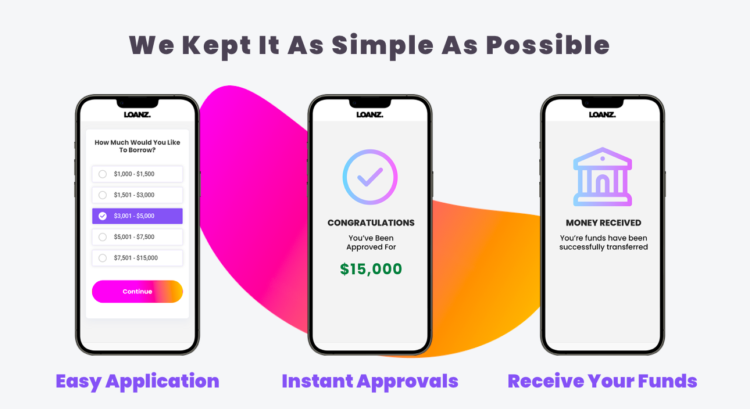

“Consumers can go to any one of the Consumer Genius Platforms and fill out a few questions,” the company explains. From there, a proprietary algorithm recommends the best course of action for that consumer and puts them in touch with an expert.

It’s private, legal, and free, according to company President Paul Hadzoglou.

“We at Consumer Genius pride ourselves on our approach in giving all consumers alike the ability to make the decisions that are right for them, without wasting their time,” he says, adding that “Canadians need fast and accurate information in todays ever changing and fast paced environment to make educated, informed decisions.”

Consumer Genius, founded in 2015, says that 40,000 users apply for financial services or products through its platforms each month.

Leave a Reply