$900 million of venture capital dollars were invested across 144 deals in the third quarter of 2022, bringing the year-to-date total above $7 billion invested across more than 500 deals as investment “continues to normalize to pre-pandemic levels,” according to the latest quarterly report from the Canadian Venture Capital and Private Equity Association.

“Canada’s VC activity is mirroring global trends, particularly that of the United States, in both deal count and in a similar drop in investment size, as investors continue to monitor market conditions and founders hold off on fundraising,” believes Kim Furlong, Chief Executive Officer of CVCA.

Furlong says one positive trend of Q3 was “an uninterrupted growth at the seed stage.”

Investment into early and seed-stage companies demonstrate the most resilience this quarter, comprising 45% and 43% of all transactions respectively. There was $152M invested at the seed stage across 62 deals, bringing the YTD total to $630M—nearly double 2020 levels.

“Investors are gravitating toward smaller deals and add-ons given challenging macroeconomic pressures,” suggests Furlong. “Investors are taking a cautious approach, prioritizing deals that require less valuation adjustments amid market conditions.”

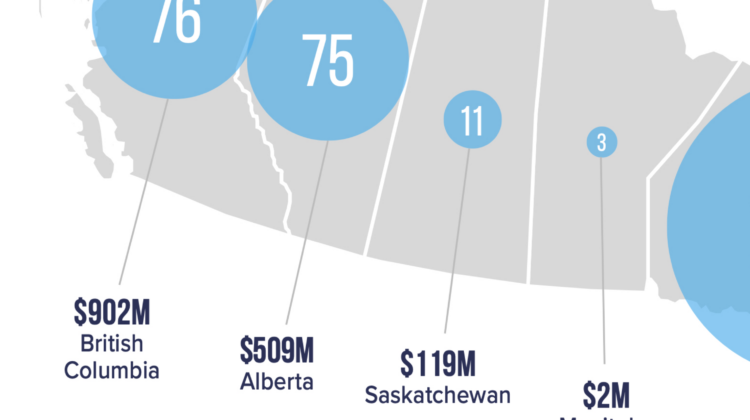

Alberta saw as many deals as B.C., however with fewer dollars invested, placing the province in fourth in Canada.

“Alberta is continuing to experience a strong year so far in 2022,” CVCA states, noting more than $500 million of capital invested across over 70 deals.

Alberta has already surpassed investment activity in both value and deal count in 2022, the report notes, with the province on track to meet or exceed 2021 figures.

ICT and Life Sciences companies drew the most investment among Alberta companies, according to the report, seeing 28 and 17 deals respectively.

Most of the VC action hails from Calgary, the province’s startup hub and a global tech market-to-watch.

Leave a Reply