Zenbase is an Alberta startup aiming to innovate rental payments via modern technology.

The Canadian company was founded with the vision of “becoming a trusted partner in managing household finances while eliminating late fees and predatory financing.”

This year, the Calgary-born firm is partnering with Mainstreet Equity to offer flexible rent payment options to residents across 16,500 units throughout the provinces of British Columbia, Alberta, Manitoba, and Saskatchewan.

One of the primary features of Zenbase’s flexible platform is allowing users to split their rent into two payments.

“Zenbase has delivered an easy-to-use and convenient payment option that has proven to be valuable for our residents, helping to relieve financial pressures by splitting rent payments throughout the month,” Trina Qui, chief financial officer of Mainstreet, stated in January.

It’s one of several partnerships Zenbase is building to empower renters in Canada in 2023.

“We collaborate with like-minded companies who want to improve the financial health of their residents by offering our powerful budgeting tool,” Zenbase founder Koray Can Oztekin affirmed recently.

In February, Zenbase partnered with socially responsible rental housing organization VIDA to push product to 2,000 households across Nova Scotia, New Brunswick, and Manitoba.

Last year, Zenbase secured $4 million in seed funding in a round led by Global Founders Capital. This capital has helped spur the startup’s recent expansions.

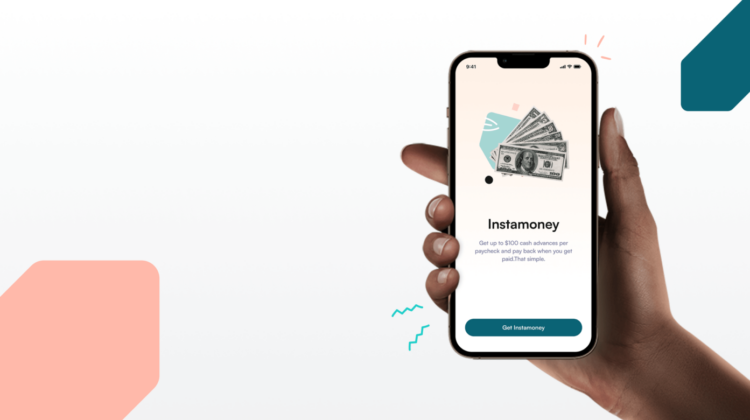

Zenbase claims to save more than $700 at an annualized rate per resident by having them avoid overdraft and late fees. The startup also offers a fee-free cash advance service, which it says more than one-third of users have taken advantage of in order to cover essential costs such as utilities, groceries, and gas.

“It’s expensive to be poor with late rent payments costing a resident as high as $150 each time,” laments Oztekin, who serves his company as CEO. “We are levelling the playing field by giving Canadians the flexibility that they need without getting penalized.”

According to Oztekin, it’s a winning situation for both residents and property managers.

“Our mission is to ensure that no one is ever behind on their rent payments or gets evicted,” the company states online, and does so by offering “financial solutions that empower residents to better navigate financial challenges that life may throw at them.”

Leave a Reply