A 2022 Calgary Fintech Award winner has raised more capital as it seeks to expand its offerings in Canada.

Woveo, a startup based in Calgary, believes that community savings and lending practices are the keys to breaking the cycle of underrepresentation of new immigrants in the Canadian financial system.

The Alberta fintech recently confirmed that it secured $2.3 million in seed funding from new and returning investors including BKR Capital, Relay Ventures, and Northpine Foundation.

The funding builds on a $1.5 million pre-seed round last year, bringing the Canadian startup’s total funding to $3.8M.

“Utilizing a rotating group savings model, Woveo has achieved an impressive 100% repayment rate, demonstrating the effectiveness of our approach,” stated Jonah Chininga, a cofounder and chief executive officer of the fintech.

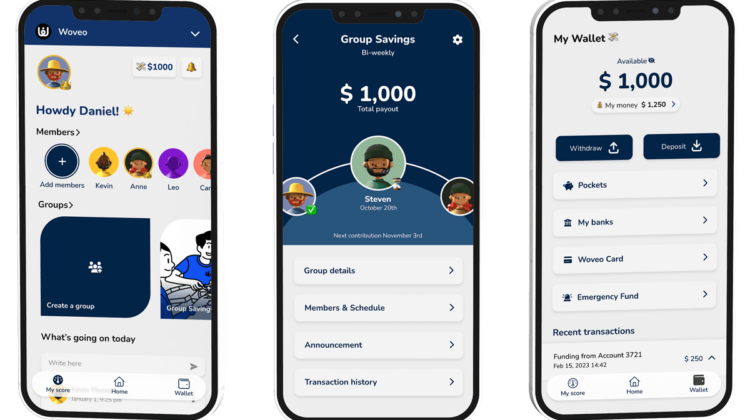

Woveo’s suite of services includes group savings, credit-building programs, credit score monitoring in partnership with Equifax, and cash advances targeting Canada’s “underbanked” communities. The company now works with 23 communities serving 18,000 members.

A flagship feature of the fintech’s platform is that it helps users build credit history by reporting lending circles’ payments to Equifax and manage a group’s money together.

“Lending Circles are groups of people who pool funds together to access interest-free loans,” the startup explains. Loan amounts range from $300 to $5,000, with each group member receiving the loan.

Woveo’s approach to community savings and lending practices enables community organizers to pool funds and fundraise in order to facilitate communal credit transactions. The app also features social payments with cash-back promotions via white-labeled physical and virtual cards designed to enhance the user experience.

The company was founded in Calgary in 2021 by Chininga as well as operating officer James Muhato and chief of technology, Sergio Fernández.

Leave a Reply