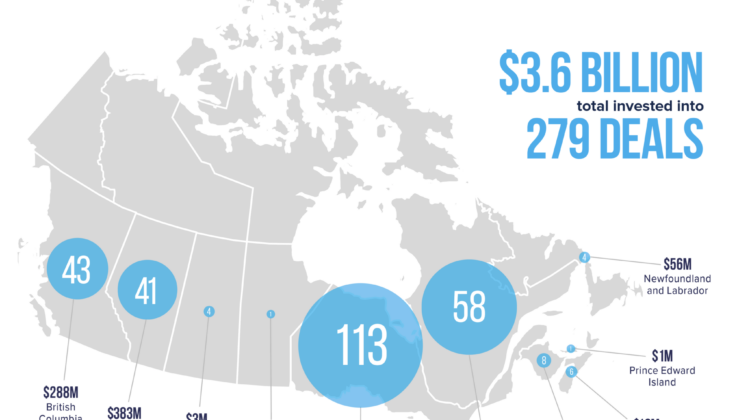

In the first half of 2024, venture capital investments totalled nearly $3.6 billion across almost 300 deals, as blood slowly returns to a pale Canada.

Despite the lowest deal volume since 2020, average deal size continues to grow, reflecting investors’ focus on companies with proven track records and strong fundamentals, according to the CVCA’s H1 2024 report, which points to an 85% increase in dollars invested quarter-over-quarter.

“The second quarter of 2024 continued the momentum we saw earlier in the year, with steady venture capital investment,” stated Kim Furlong, chief executive of CVCA. “This performance is driven by investors doubling down on companies with proven track records and strong fundamentals, as they continue to navigate the environment cautiously.”

The CEO did have some concerns, however.

“While this performance demonstrates resilience, the persistent decline in seed deals raises concerns about the long-term pipeline of investment-ready companies,” continued Furlong. “We will continue to monitor this trend closely as it could impact the sustained growth of the ecosystem.

Breaking things down regionally, the province of Alberta surpassed B.C. for the first time in terms of investment dollars attracted, drawing a total of $383 million across 41 deals versus $288M across 43 deals for BC.

Those figures place Alberta in third nationally, behind heavyweights Ontario and Quebec, who each drew more than $1B in capital.

Alberta’s podium placement may be temporary, however, given the circumstances: Energy technology company ClearSky Global provided a major boost to the province’s numbers thanks to a raise of more than $200M in June from an undisclosed group of investors. That kind of capital raise doesn’t happen every quarter.

Still, it’s an achievement worth celebrating, and reinforces signs that Calgary is increasingly a magnet for investment.

Leave a Reply